FRED Data Feed

This post describes a feature the v1 engine. The v2 engine also supports FRED, but the method of bringing in quotes is slightly different.

If you are serious about data-driven investing, your hunger for data probably goes far beyond price action and volume. The Federal Reserve Economic Database, or FRED for short, offers 530,000 data series of economic data. And our latest TuringTrader release makes it as easy as 1-2-3 to access these data.

Meet FRED

The economy has many facets: production and income, employment, personal consumption and housing, sales and inventories, gross domestic product, or bond yields. Regardless of which angle you take, FRED has the data. Here are just a few series to try:

Many of these series span several decades of history, allowing extended backtests. But most noteworthy: all these data are accessible through a fast API and free of charge.

Economic Data at Your Fingertips

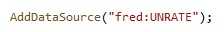

In a previous post, we introduced implicit data source descriptors. Because of this feature, bringing in FRED data is a breeze: All you have to do, is to add a DataSource with FRED’s series ID, preceded by “fred:” as its nickname:

TuringTrader will load the data series, and cache the data on disk for offline access and to speed up future access. Further, TuringTrader will pad the data, to line them up with market trading days, so that you can run your favorite indicators on these series, the same way you do with quotes.

While we are writing this (in June 2019), we are confronted with concerns about a looming recession daily. People are wondering how much longer the stock market is going to rally, and when it might be time to get out. Using the FRED data feed, you can now enrich your trading strategy with macro-economic signals. Consequently, this results in a more holistic approach to investing and trading and improves the predictive power of indicators.

Happy coding!