Larry Connors' and Cesar Alvarez' Short-Term Strategies

This post describes a showcase for the v1 engine. Check out our showcases for the v2 engine.

In their books ‘High Probability ETF Trading’, and ‘Short Term Trading Strategies That Work’, Larry Connors and Cesar Alvarez describe a collection of mean-reversion strategies. We implemented these strategies as a showcase for TuringTrader.

Short Term Trading Strategies That Work

This book describes a total of 8 strategies. We implemented all of them using a common abstract core class. Next, we have derived classes from this core, and implemented a single method with the trading rules for each strategy. The rules are typically very short, and can be implemented in about 30 lines of code. We have exposed most of the strategy parameters, so that they can easily be tweaked using TuringTrader’s grid optimizer.

Thanks to their common structure, this is a great starting point to mix & match the various strategies: can you combine the 5 strategies from Chapter 12 into a single meta strategy?

High Probability ETF Trading

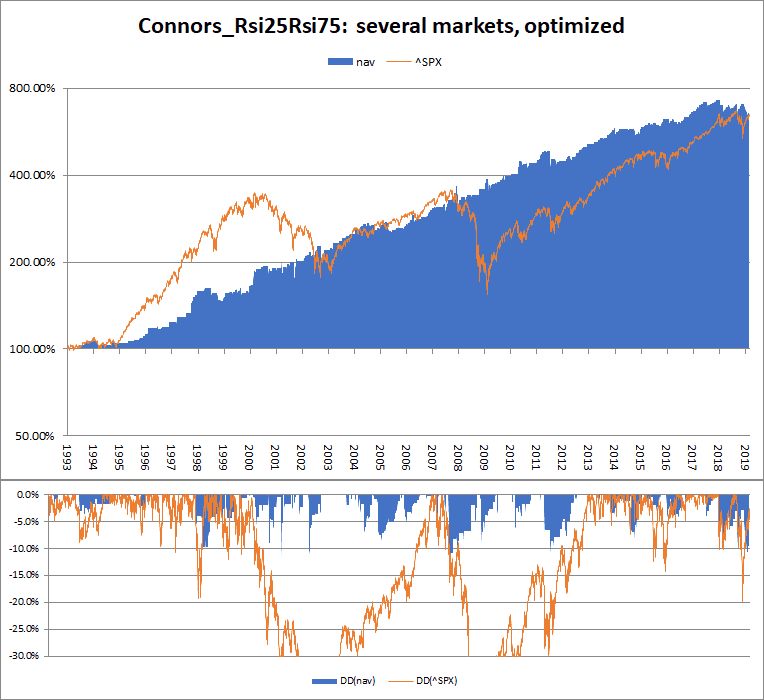

This book describes a total of 7 strategies. Similar to the previous book, we implemented all of these using a common abstract core class. We have derived individual classes from this core, implementing a single method with the trading rules. Unlike the strategies from the previous book, these are slightly more complex: we needed about 40 lines of code to implement the rules for each strategy. For this added complexity, we get two features: First, all strategies work on both the long and the short side. And secondly, all strategies use some form of scaling into positions, where position sizes are increased after the market provided additional confirmation.

Again, we feel this is a great starting point for your own experiments.

We hope that this showcase demonstrates TuringTrader’s capabilities, and helps you spark some new trading ideas. If you are just curious and like to see how well these strategies do, head over to TuringTrader.com, where we have daily updated charts and metrics.

Happy coding!