MFE/ MAE Analysis

This post describes a feature of the v1 engine. We will likely port it to the v2 engine, but it is currently not a priority.

When optimizing a strategy, it is helpful to analyze the trades that a strategy has taken. While TuringTrader offers the complete order log for analysis, it was a bit harder to extract the information required for MFE/ MAE analysis. We have changed that with the latest release.

Order Log

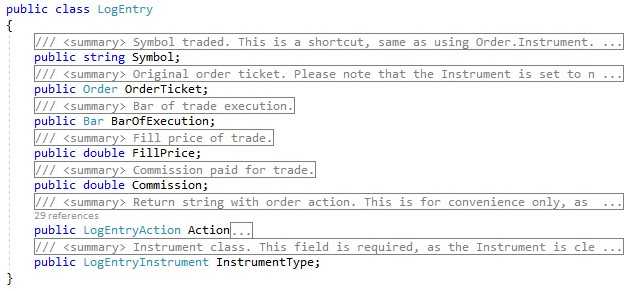

Whenever TuringTrader executes an order, a new entry is written to the order log. The order log entries contain the following elements:

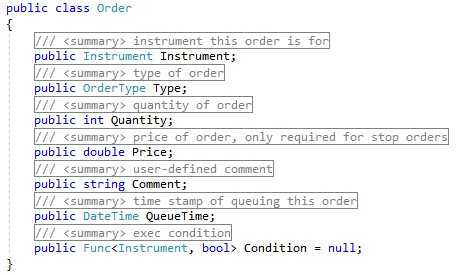

We see that the order log entries also contain the original order ticket, containing the following elements:

Entry + Exit = Position

This info allows us to fully reconstruct the situation that led to placing each order. But for a complete analysis of how a trade developed, we need to know what was going on between entry and exit.

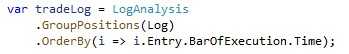

The first thing we need to do, is to group entries and exits together, to form positions. This is what TuringTrader’s LogAnalysis class does for us in a simple step:

Please note that the entries and exits can be grouped either using the Last-In-First-Out, or the First-In-First-Out methods.

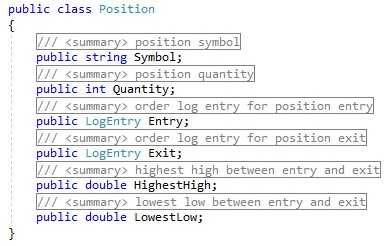

The trade log is a list of positions with the following fields:

Calculating MFE and MAE

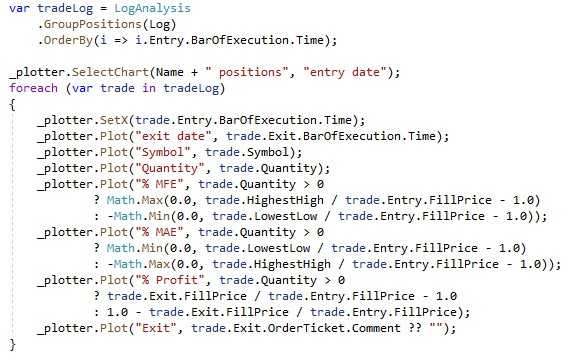

We’ve had the ability to group entry and exit orders to positions for a little while now. What’s new, are the two fields HighestHigh, and LowestLow. These two fields allow us to calculate the Maximum Favorible Excursion (“MFE”), and the Maximum Adverse Excursion (“MAE”). Here is some sample code putting this all together:

This code will produce a log looking like this:

The information is all there, now it’s up to you to use it. How about creating a scatter plot, instead of writing to a table?

Happy coding!