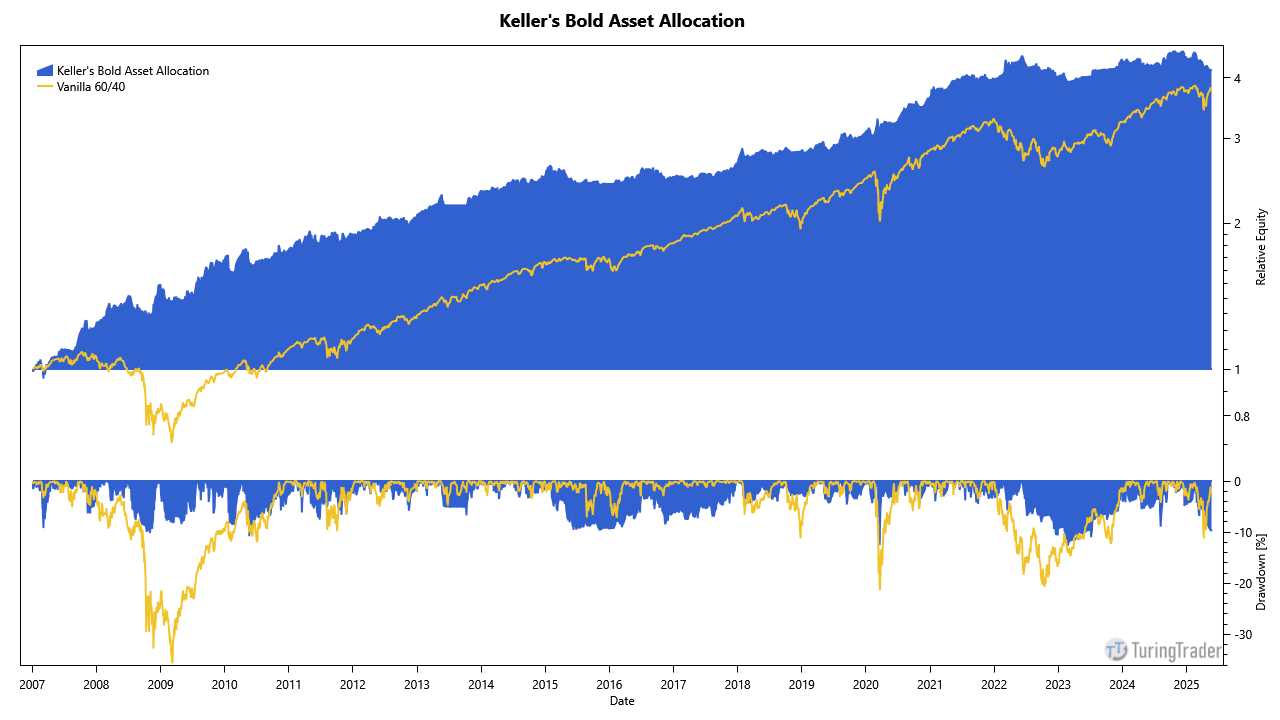

Keller's Bold Asset Allocation

With the v2 engine development well under way, we need to implement some test strategies to see how well the new paradigms are working. For our first real-world experiment, we chose Keller's Bold Asset Allocation.

- chart courtesy of TuringTrader.com

As we hoped, the strategy was very easy to implement. The strategy's main core is about 200 lines of (heavily commented) code. We like how the relaxed rules for indicators improve code locality, while the allocation-based order paradigm makes money-management more concise. Thanks to using lots of LINQ, most of the code follows a functional paradigm, significantly reducing conditionals and loops. With the asset backfills now part of the distribution, the strategy can be backtested significantly further back than the inception date of the ETF's used. We like it!

Stay tuned and happy coding!