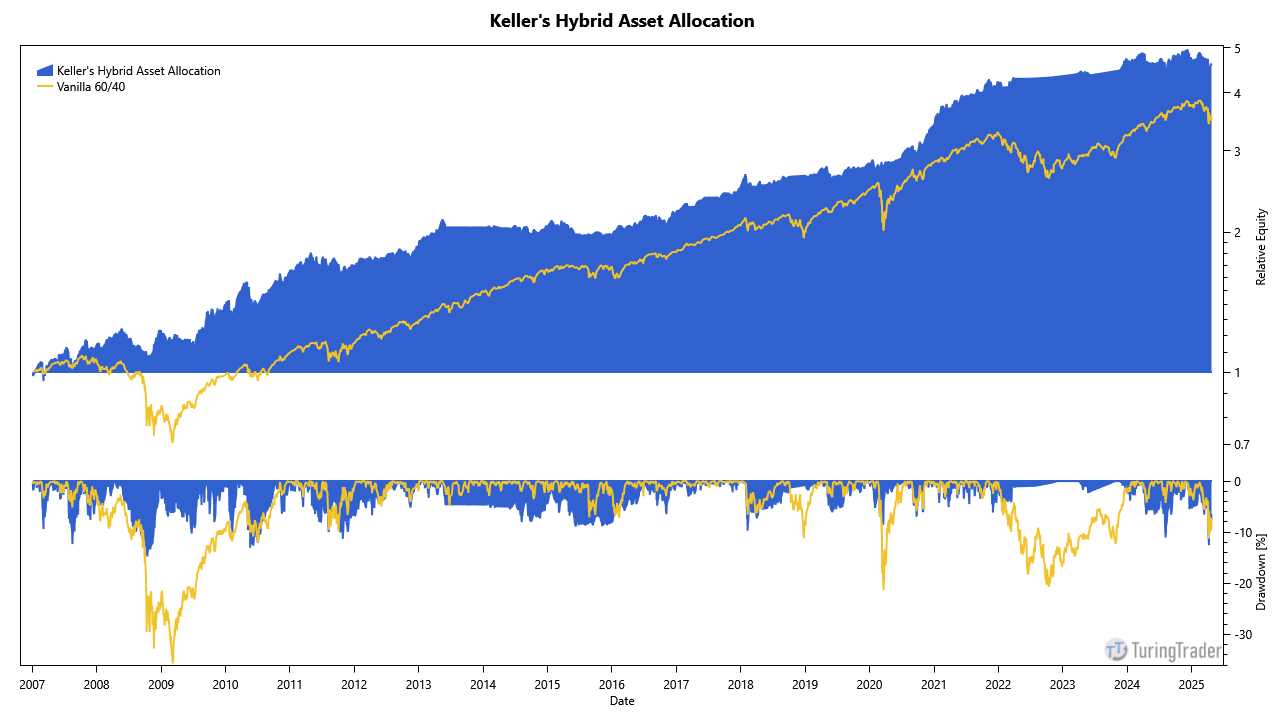

Keller's Hybrid Asset Allocation

See also

Keller's Hybrid Asset Allocation is a follow up on his Bold Asset Allocation. The new strategy aims at retail investors, thanks to its smaller universe and simpler construction. Unlike the previous BAA, HAA uses only a single asset for its canary universe. The total return of inflation-protected treasuries, TIPS for short, is used to detect market crashes, along with a dual-momentum approach to weed out assets with negative returns. The result is a strategy with lower cash fraction, reduced turnover, and higher returns. At the same time, the new strategy's risky assets remain diversified across two asset classes under all circumstances.

- chart courtesy of TuringTrader.com

We implemented the strategy as another showcase for the new v2 engine. As before, the source code is very clean and concise, with the strategy logic consuming only about 60 lines of code. The code is easily readable, thanks to its high locality. Further, thanks to using LINQ, the code mostly follows a functional paradigm, greatly reducing the use of loops and conditionals. We like it!

Stay tuned and happy coding!